Such a simulator could also be used to address issues of regulation and certification.

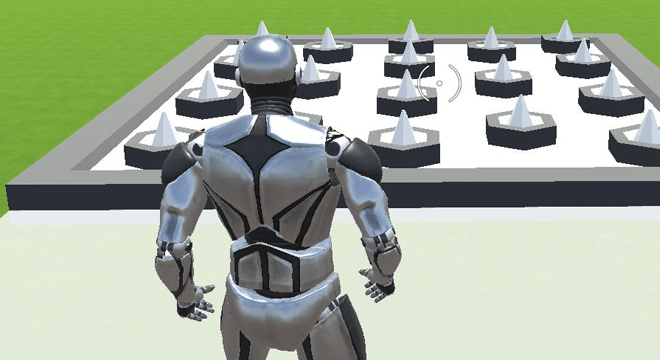

Use this simulation to explore the “operational envelope” of the current state of the markets, as a hypothesis generator, searching for scenarios and failure modes such as those witnessed in the Flash Crash, identifying the potential risks before they become reality. The proposed strategy is simple enough to state: build a predictive computer simulation of the global financial markets, as a national-scale or multinational-scale resource for assessing systemic risk. The global financial markets have become high-consequence socio-technical systems of systems, and with that comes the risk of problems occurring that are simply not anticipated until they occur, by which time it is typically too late, and in which minor crises can escalate to become major catastrophes at timescales too fast for humans to be able to deal with them.Ĭliff and Northrop say that we should do exactly as Kearns suggested: The US sell-off would have triggered big market swoons in Asia and Europe, with very nasty consequences for, among many other things, Greek debt dynamics. But now a new paper from the UK’s Government Office for Science, written by Dave Cliff and Linda Northrop, lays out the case for building such a simulator over the course of 47 very interesting pages.įirst of all, they write that the whole global economy “dodged a bullet” on May 6, 2010: if the Flash Crash had just happened a couple of hours later - and there’s no reason it couldn’t have done so - then the US markets might well have closed before the Dow had a chance to recover. Kearns’s idea didn’t get anything like the traction it needs, and it’s not going to happen. People on Wall St think about simulation, but not for catastrophe prediction, just for their own trading purposes. We have no such lab for our financial markets.

We’d be much better off with a simulator. And in reality problems which weren’t tested for get discovered. I’m proposing a quant version of the stress tests that were proposed for banks.Ī car company, before they roll out a product, have a lab environment where they put it through tests. But if you don’t find a disaster, that’s not reassurance that some other disaster won’t happen.

If you do a simulation and you try some perturbation or stress, and it tells you that a disaster happens, then it’s worth thinking hard about our current markets. You’d have high-frequency algos, shorter-term stuff, dark pools, multiple exchanges, etc. You can imagine trying to build an ambitious, reasonably faithful simulator of our current markets. Markopolos eyes a fortune from BNY whistleblowing

0 kommentar(er)

0 kommentar(er)